The world is presently sharing a limited supply of oil. When oil prices rise, oil production doesn?t rise very much, if at all.

The issues then become: Which buyers get the oil? What users get priced out of the market? ?Which countries are disproportionately affected?

Figure 1. Brent oil spot price and world oil supply (broadly defined), based on EIA data.

It seems to me that this time around, Europe, and in particular the Eurozone, is the area of the world getting hit the hardest by high oil prices. Part of this has to do with the relative level of the Euro and the US dollar. If we look at the price of Brent oil (a European oil) in Euros (Figure 2), we find that prices are as high now as they were in mid-2008.

?

Figure 2. Dated Brent average monthly oil prices, expressed in Euros, based on?IndexMundi data.

The situation in the United States is fairly different. The dollar-Euro comparison works more in the favor of the US, so that the rise of Brent in US dollars has been smaller this time than in 2008. In addition, refineries in the United States have been fortunate enough to purchase quite a bit of the oil they buy at prices below that of Brent. The issue leading to lower prices in the United States is lack of pipeline capacity, creating a bottleneck for shipping oil to Gulf Coast refineries. (See my earlier articles,?Why are WTI and Brent Prices so?Different??and?Pipeline changes to fix WTI/Brent spread are likely to add new?problems.)

?

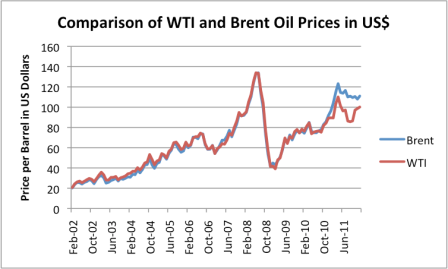

Figure 3. Comparison of West Texas Intermediate (WTI) and Dated Brent Oil Prices, expressed in US Dollars. Data from?IndexMundi.com.

Figure 3 shows two different benchmark prices of crude oil in the United States: Brent and West Texas Intermediate (WTI). Oil that is imported to the United States from Europe and Africa can be expected to follow Brent prices, as will oil that is produced along the Gulf Coast, and has convenient access to Gulf Coast refineries. Oil that comes from the North, such as crude from Canada and the Bakken, is subject to pipeline limitations, and its price will tend to follow that of WTI (or trade for an even lower price than WTI). Oil purchased by US refineries thus reflects a blend of WTI and Brent prices, and perhaps some lower ones as well. Based on Figure 3, it is clear that the current prices are far below the 2008 price peak, quite unlike the situation shown in Figure 2 for Europe, with Brent priced in Euros.

Availability of Locally Produced Oil versus Imports

Europe?s oil production has been declining since about 2002.

?

Figure 4. Europe "all liquids" oil production (including biofuels and natural gas liquids) based on EIA data. 2001 estimated based on 11 month data.

This decline in oil production by itself has a negative impact?fewer jobs and less tax revenue.

In comparison, oil production in North America (Figure 5, below) has been much more level, and has even been rising somewhat recently. A rise in US and Canadian production has helped offset a decline in Mexican production. Since the amounts shown are ?all liquids,? the amounts shown include biofuels and natural gas liquids, which are oil supply extenders, but are not true ?crude oil.?

?

Figure 5. North American "All Liquids" production, including crude oil, natural gas liquids, and biofuels, based on EIA data. 2011 estimated based on 9 months data.

An even more important issue, though, is that European oil does not benefit all European nations. Instead, it is the countries that extract the oil that benefit, primarily Norway and the United Kingdom. Countries that do not extract the oil must import any oil they use.The countries that import oil generally import natural gas as well, at prices that are partially tied to the price of oil, so they are hit doubly hard.

Paying for these high-priced imports reduces the amount that residents of these countries can be spend on other discretionary goods, and contributes to a tendency toward recession. Furthermore, if a country is not producing oil and natural gas itself, it does not get the offsetting benefits of additional jobs in the oil and gas sectors.

?

Figure 6. Percent of Energy Consumption from Imported Oil and Gas, for selected countries, based on BP Statistical Data.

Figure 6 shows that the PIIGS countries are all very heavy importers of oil and natural gas. In fact, they are the five countries listed on the on the left of Figure 6, with the highest level of imports. When oil prices rise, these countries are disproportionately affected, because, for example, tourists can no longer afford vacations in their countries. Their?debt problems are in part tied in to high oil prices, since when workers are laid off, a country collects less in taxes and needs to pay more in benefits to unemployed workers.

The US has a relatively low level of imported oil and gas imports compared to most European countries. This occurs partly because of its significant use of coal and nuclear, and also because of the large size of its own oil and gas production.

Another factor that helps the United States in dealing with high energy prices is its current low price of natural gas, relative to that of Europe and Japan (Figure 7).

?

US natural gas prices are currently extremely low, because of an imbalance between natural gas supply and demand. These low prices for natural gas mean that the cost of home heating and of electricity are now lower than they have been historically in some parts of the country. These lower heating and utility costs help offset the rising price of oil. The issue of why US natural gas prices are so low will be the subject of another post in the near future.

The low price of natural gas also makes the cost of refining heavy oil less expensive in the United States than elsewhere, because natural gas is?used by complex refineries that refine heavy oil, both as a feedstock, and to fire the furnace that heats the crude oil. This makes the United States a sought out destination for refining heavy crude oil, and helps add jobs to the US economy. For example, nearly half of crude oil imported from Mexico to the US is exported back to Mexico as oil products, according to EIA data. EIA data also shows that we import crude and export a smaller amount of products back to Canada, Brazil, Ecuador, and Venezuela. ?The low price of natural gas is thus a reason US product exports, such as diesel and gasoline, have been increasing recently, even though the United States continues to be a big importer of crude oil.

This?post?originally appeared at?Our Finite World.

censoring the internet blackout blackout congress censored darvish jerry yang

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.