By John Nyaradi

A sea change is underway for Apple Computer and the tech sector and major dangers and opportunities will unfold as this tidal wave rolls ashore. Long before Apple Computer (AAPL) became the most watched stock in the world, a book called The Personal Computer Book by Peter McWilliams was published back in 1982.

Apple still makes headlines today but many of the exciting companies, which were introduced to us in The Personal Computer Book, have either died or they have been consumed by other corporations (in the manner that Compaq was cannibalized by Hewlett Packard (HPQ)). Kaypro Computer, the manufacturer of a metal-encased unit which was as portable as a sewing machine, filed for bankruptcy in 1992. Digital Equipment Corporation (or DEC) was consumed by Compaq in 1998 before Compaq was eaten by HP in 2002. Commodore International, which brought you the Commodore 64 and the Amiga, was laid to rest in 1994.

Apple still makes headlines today but many of the exciting companies, which were introduced to us in The Personal Computer Book, have either died or they have been consumed by other corporations (in the manner that Compaq was cannibalized by Hewlett Packard (HPQ)). Kaypro Computer, the manufacturer of a metal-encased unit which was as portable as a sewing machine, filed for bankruptcy in 1992. Digital Equipment Corporation (or DEC) was consumed by Compaq in 1998 before Compaq was eaten by HP in 2002. Commodore International, which brought you the Commodore 64 and the Amiga, was laid to rest in 1994.

The central character of The Personal Computer Book was a little company in Seattle named Microsoft (MSFT), which developed a "disk operating system" called MS-DOS at the request of IBM. IBM (IBM) wanted to start manufacturing a product line called personal computers. Their entire PC line was built around computer chips called "central processing units" or CPUs which were manufactured by a company named Intel (INTC).

By 2013, Microsoft, IBM and Intel appear to be heading to the same - or similar - fate as the other companies mentioned in The Personal Computer Book. Worse yet, a company named Dell Computer, (DELL) which developed a massive customer base by direct sales of PCs to customers through ads in such magazines as Computer Shopper and PC, now faces an uncertain fate after founder, Michael Dell first announced plans to take the company private, with the assistance of a private equity firm named Silver Lake Partners. As it turns out, the large-stake shareholders are not happy with the $13.65-per-share buyout price. On August 22, 2008 - just before the collapse of Lehman Brothers - Dell was trading at $25.50 per share. Dell hasn't been traded for $18 per share since February 21, 2012.

The fate of the personal computer extends beyond the good - or bad - fortunes of any particular company. At this point in American history, the personal computer is headed for the same fate as the Leisure Suit. It is rapidly becoming antiquated technology.

Smartphones and pads are replacing the clunky units with their spinning metal-disk hard drives, as consumers are increasingly entrusting their most private, personal information, photos and videos (yes - that kind, as well) to complete strangers who operate mainframe computers known as the cloud.

This sea change in digital technology is changing the entire tech sector from the investment standpoint. Microsoft, which just found its way back to $32 per share after spending most of the post-Lehman years in the $25 range (with the exception of last year's spring fever) is increasingly becoming a target for ridicule.

In fact, an online dispute arose at a popular news website after one commentator characterized Apple as "the new Microsoft". (Oh, snap!) As die-hard Apple investors stubbornly clung to their positions while the share price plunged from $702 on September 19 to $390 on April 19, it is easy to understand why.

The fate of Intel Corporation is inexorably linked to the well-being of its biggest customers in the PC manufacturing industry. At this time last year, Intel was clawing its way back to $29 per share. These days, you are lucky if you can unload those shares at $22.

A good number of investors who survived the dot-com bubble, which came to grief in March of 2000, are nervously fretting about what to do with their technology sector shares. Because the entire tech sector rises and falls with the prices of those four relics of the PC era, many see the entire sector as radioactive.

Which brings the discussion to Apple Computer, the tech industry darling which is now locked in a significant bear market as it struggles to maintain its dominance.

The company's recent earnings report was lackluster, at best, as iPhone sales decline and margins shrink. Apple stock has taken a sharp decline from the lofty peaks in the $700/share range to close on Friday at $417.

Numerous brokers have cut their price targets for Apple and now there's a wide range of targets between $400-$800 per share.

The company reported revenues that were better than expected and good sales for the iPad. However, Apple reported declining profits for the year over year period and declining gross margins. Slowing growth is bad news for an innovation leader like Apple and the rest of the world seems to be catching up with Samsung (SSNLF.PK) pressing them in the phone market and Amazon (AMZN) in the tablet world.

Apple is losing market share as its iPhone sales grew just 7% year over year while Samsung shipped more than 60 million smartphones in the first quarter, giving it 30% of the global smartphone pie compared to Apple's 37 million phone sales and 17% of the market.

Apple also issued lower guidance for the upcoming quarter and that it has no new products to release until autumn, another bad news omen for a company that depends on innovation and invention.

Apple's big announcement during the earnings call was that it's going to give shareholders $100 billion in buybacks and dividends, which is a departure from previous practice and obviously an attempt to offset the pain of a a 40% decline in the value of Apple stock.

The sea change in tech from personal computers to mobile and tablets is accelerating minute by minute and which companies will be winners and which will be losers remains very much in doubt. Key players include Apple, Amazon and Google (GOOG) and, of course, the old line names like Microsoft, IBM, Dell and Hewlett Packard, who will struggle to stay relevant and not become dinosaurs in this new age.

For investors, stock picking in this new age could become treacherous, at best, as the battle for survival and supremacy plays out. Here is a list of some ETFs you may want to consider as alternatives to investments in individual tech sector companies:

For tech bulls:

PowerShares QQQ Trust ETF (QQQ): This ETF, formerly known as the "Nasdaq 100 Tracking Stock", invests in all of the stocks in the Nasdaq 100 Index, which includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Technology Select Sector SPDR ETF (XLK): This ETF invests in all of the equity securities of the Technology Select Sector Index in the same proportion as the investments in those companies made by the index itself.

For tech bears:

ProShares Short QQQ ETF (PSQ): This ETF seeks daily investment results which correspond to the inverse (-1x) of the daily performance of the NASDAQ 100 Index. QQQ invests in derivatives which ProShares Advisors believes, in combination, should have similar daily return characteristics as the inverse (-1x) of the daily return of the index.

ProShares UltraShort QQQ ETF (QID): This ETF seeks daily investment results which correspond to two times the inverse (-2x) of the daily performance of the NASDAQ 100 Index. QID invests in derivatives which ProShares Advisors believes, in combination, should have similar daily return characteristics as two times the inverse (-2x) of the daily return of the index.

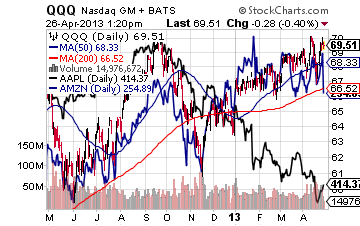

A quick look at a chart of QQQ offers insight into the current condition of the tech sector:

In this chart of QQQ we can see how the index (candlesticks) has been in an uptrend and the blue line of Amazon closely tracks the direction of the QQQ index.

However, we can see how the black line of Apple stock prices has wildly diverged from the overall sector.

Apple makes up a significant percentage of the weighting in QQQ and so it's unlikely that this divergence can continue. It's very likely that either Apple will have to rally or that QQQ will decline to a point where the two are again in synch with each other.

Bottom line: In today's world, the rate of change will only continue to accelerate as mobile and tablets and the cloud crowd out PCs, mainframes and semi-conductor based computing products. Picking individual winners and losers will be a gamble, at best. However, tech index ETFs like QQQ and PSQ will offer investors opportunity to profit from both the rise and fall of the tech sector tide.

Disclosure: Wall Street Sector Selector actively trades a wide range of exchange traded funds and positions can change at any time.

Disclaimer: The content included herein is for educational and informational purposes only

Source: http://seekingalpha.com/article/1379441-the-rise-and-fall-of-apple-and-the-tech-sector?source=feed

nor easter veep los angeles kings timothy leary jonathan frid pujols watchmen

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.